Making Sense of Your Company's Retirement Plan

/ I meant for this post to be part of the week's series on starting a new job, but I get questions about retirement plans all of the time from people who have had accounts for years. The truth is that most employees feel a little vague at best about the details of their retirement plans. This post will try to break down the basics to help you fit your employer's retirement plan into your planning and, in some cases, raise the questions that might lead your employer to improving the plan itself.

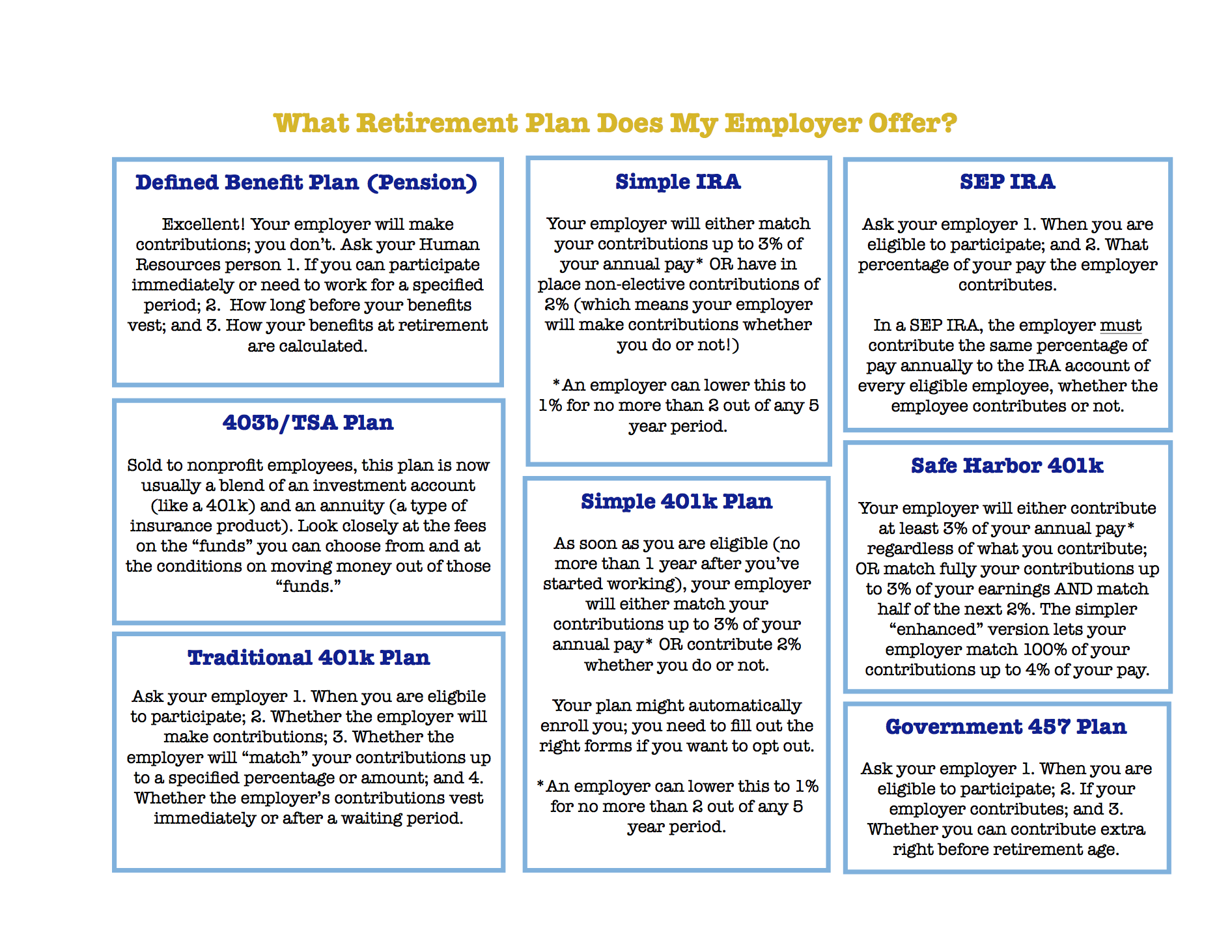

So what do you need to know about your retirement account? Read the key points I've given you below and then find whatever qualified plan your employer is offering on the chart at the bottom to gather specific questions you should be asking your employer.

I meant for this post to be part of the week's series on starting a new job, but I get questions about retirement plans all of the time from people who have had accounts for years. The truth is that most employees feel a little vague at best about the details of their retirement plans. This post will try to break down the basics to help you fit your employer's retirement plan into your planning and, in some cases, raise the questions that might lead your employer to improving the plan itself.

So what do you need to know about your retirement account? Read the key points I've given you below and then find whatever qualified plan your employer is offering on the chart at the bottom to gather specific questions you should be asking your employer.

Tax Deferrals

Whatever plan you have, you should know what the big deal is about retirement accounts—it's all in the tax breaks. The majority of "qualified" retirement accounts allow you to put part of your paycheck into the account and deduct that money from the income you list on your tax filing for the year. This is great for two reasons: 1. you pay fewer taxes that year; and 2. the money you were going to put toward taxes can start earning money itself through investments.

You do eventually pay those taxes. When you start taking money out of the account (hopefully in retirement), you will pay a tax on both the money you put in and the extra earnings you take out. In the meantime, though, you should have been able to make a lot more in investment returns thanks to this "loan" of your tax dollars from the government.

More Tax Deferrals

In the case of Roth IRA's, the government offers you a slightly different deal on your taxes. With these accounts you do pay your taxes this year on the money you put in but don't have to pay any taxes while you investment account is earning. Why does this work? As with tax-deductible plans, you can keep reinvesting the money your investments earn year after year without paying the taxes until you take money out. But you also have the benefit of being able to take out that original contribution tax-free (because, of course, you paid the taxes before putting the money in). This works well if you think your income tax rate in retirement will be lower than it is right now. People often use the Roth as a second retirement account to save more than they can under an employer's plan.

Fancy Terms You Should Know

There are a few key words and terms that make all of the difference in understanding retirement plans. Here are some:

Vesting: With some plans the money is yours as soon as it hits your retirement account. You may have to pay a penalty to the IRS for taking it out early, but your employer has no more claim on the money. With other plans, the "ownership" of some or all of the retirement account money does not pass to you until it vests, usually after you've worked a specific number of years for the company.

Qualified Contributions: These are the contributions you and/or your employer make that are tax deferred. All retirement plans have limits on these—often you can add more to your account, but you don't get that tax break after you hit the qualified contribution limit.

Matching: In many plans, your employer has agreed to contribute its own money to your retirement account whenever you do. How much the employer adds depends on the terms of the account, but we usually talk in terms of percentages (does your employer match 100% of your contribution or 50%?) and limits (the employer will stop matching when it reaches a certain amount or percentage of your salary).

Contribution Limits: Every year the IRS announces what the limits will be on how much you can put into retirement accounts and still get those great tax breaks. Here they are for 2015.

The Risks

In the rush to get you to invest in your retirement plan, we in the financial industry often forget to tell you something really important—there is a good reason NOT to contribute. Specifically, it can be extremely expensive to get that money out of your plan if you need it before retirement. You are always going to pay any taxes you did not pay when you contributed, of course. But unless you fall under one of the special exceptions, taking money out of your qualified retirement account early (usually before the age of 59 1/2) will mean paying a 10% penalty to the government. Ouch. Make sure you have some other funds or go-to plan for emergencies before you put yourself in the position of paying extra to get to your own money.