What To Do When The Stock Market Drops

/Just in case you've been reading any of the ominous predictions about our lazy "bull" market or about the panic in China's market, I thought it was a good time to talk about when you should be making changes in your investment account. The short answer to "what should I do when the market drops" is easy—not much. But there are some reasons to do some trading in your account. Here are some things that go wrong in investment accounts—and how often you should check on your accounts to fix them:

- Lazy cash. You've set up your investment accounts, bought your first stocks or funds and started adding regularly to your account. Great! But if you don't make some kind of arrangement for your new deposits to get invested, all of that money you are adding to the account might as well be stuffed under your mattress. If possible, automate your account to invest new deposits and check quarterly. Otherwise schedule a review monthly or quarterly (depending on how much you are adding) to invest the new cash;

- Out-of-Whack Allocations. You've created a fantastic portfolio model for your investments and bought all the right percentages of large cap stocks, bonds, small cap stocks, etc..., and now you can sit back and let it work. Except that, as it works, some of your assets will be doing better than others. Over time, this means that one of or two of your asset classes will be growing larger and faster than others. At some point, you will need to rebalance. Notice that this mean buying the kinds of investment that did worse in the market. This is not a mistake—markets frequently cycle so that the investment on the bottom this year is likely to be on top a year or two from now. Check a minimum of once a year up to four times a year to be sure that you are still within range of the portfolio model you originally designed;

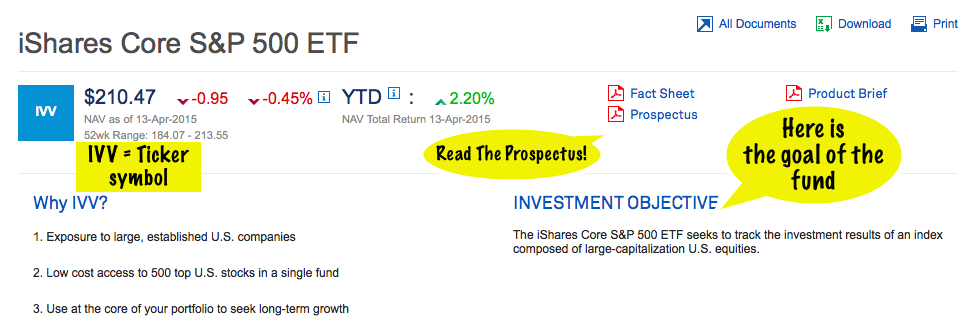

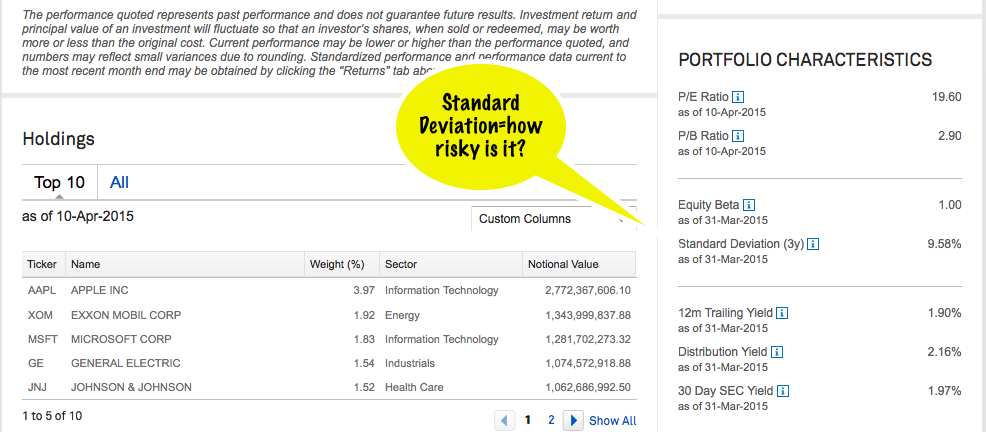

- Change of plans. Sometimes it's your plans that change; other times, it will be a fund manager or company. If you are invested directly in stocks, this may be a case of your chosen small-cap company being bought out by a large multinational. If you are in funds, you may find that the original investment objectives of the fund has changed from investing in a good mix of stocks and bonds to primarily bonds (if you were counting on this fund for your bond allocation, you need to come up with a substitute). At your once a year check, take a look at the investments in your account ("positions") AND click on the name of funds to review their holdings.

And here is the #1 reason not to make changes in your investment account: stock market headlines. Why? Because you came up with a plan for how you want to manage your investments, and if that plan did not account for the ups and downs of every stock market, then it really wasn't a plan to begin with. Don't get thrown off by people trying to create more readers.